Money

Nearly half of Americans say they’re entering 2026 with mounting financial pressure, and 48% feel more stressed now than a year ago. Jill Schlesinger dives into the reasons behind these worries and offers a look at possible resolutions.

401(k) Plans

IRAs

Deciding when to start saving, how much to contribute, and where to invest are pivotal steps for a strong 401(k). As regulators consider opening the door to alternative assets, preparing your retirement strategy now will help ensure greater financial security.

401(k) Plans

Early Retirement Planning

This concise checklist provides professionals with a roadmap to secure their financial future. It highlights six main components—budgeting, insurance, investments, taxes, emergency funds, and retirement planning—to lay the groundwork for long-term stability.

Early Retirement Planning

A recent “Savvy Senior” column highlights a little-known Social Security strategy that has been around for years, allowing retirees to claim a lump-sum benefit. Though not widely recognized, this method may provide a useful financial boost for those who qualify.

Early Retirement Planning

A 66-year-old, born in June 1959, is preparing to leave the workforce due to poor health. Losing a spouse in March has further complicated decisions about Social Security, and this piece examines key options available at a full retirement age of 66 years and 10 months.

Early Retirement Planning

Retiring early—well before 65—has become a popular goal among young adults, fueled by the growing FIRE movement. This article explores the question of whether it’s truly possible to leave the workforce by 30, with ChatGPT offering a fresh perspective on financial independence.

Early Retirement Planning

Some of AI’s most influential figures, including Sam Altman, believe AI stocks may be overpriced. Investors and retirees alike are pondering whether to adjust their retirement portfolios in light of these warnings.

Early Retirement Planning

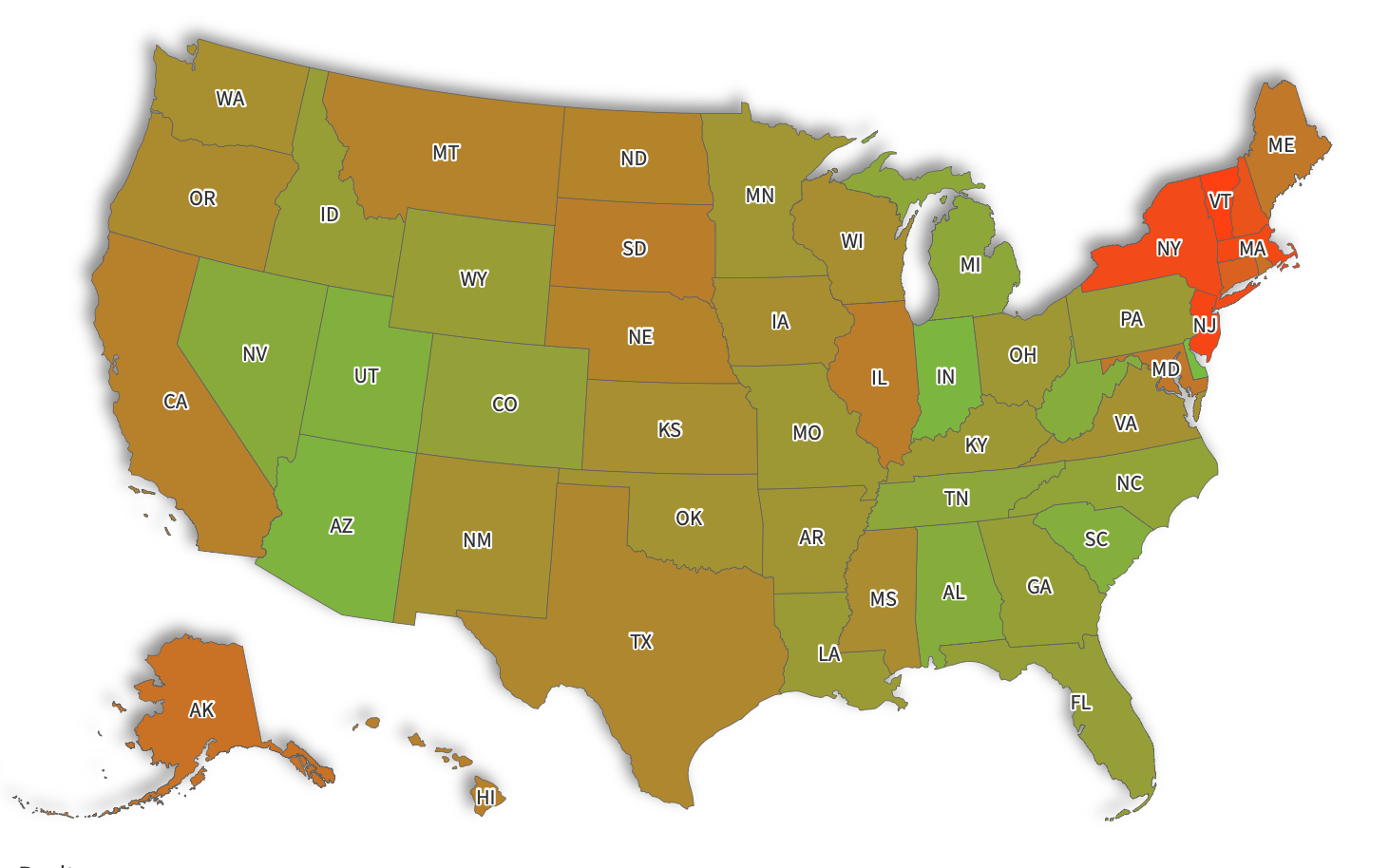

A new analysis shows that Social Security benefits alone are enough to cover retirement expenses in only 10 states. Experts say the data underscores how cost-of-living increases have eroded Social Security’s ability to meet daily needs for many retirees, highlighting the growing challenge for older Americans navigating financial stability.

Early Retirement Planning

Retirees may gain from a higher Social Security Cost-of-Living Adjustment (COLA) in 2026, but it might not be entirely good news. A big adjustment can come with caveats, underscoring the need for financial vigilance in retirement planning.

Early Retirement Planning

A new analysis by Seniorly warns that retirees in 41 U.S. states, plus Washington, D.C., could outlive their savings. In one state, the shortfall nears an astonishing half a million dollars—underscoring the depth and urgency of this nationwide concern.

Early Retirement Planning

Investors looking to secure their financial future might consider four high-yield ETFs—FDVV, SCHD, VOO, and VYM—that aim to deliver both steady income and capital growth. With low cost, lower risk, and a balanced mix of holdings, these funds could support a long-term retirement strategy.

Early Retirement Planning

Roth IRAs are one of the nation’s most popular ways to save for retirement, offering unique tax advantages. However, as the name suggests, the 5-year rule can puzzle even the most diligent savers. Here’s a closer look at what you need to know.

Early Retirement Planning

IRAs

After opting for early Social Security benefits and part-time work, one individual faces a new challenge: can switching to a taxi driver job affect their benefits? Understanding the implications of career changes during early retirement is crucial.

Early Retirement Planning

Evered Financial Inc., a Ft. Mitchell-based firm, is hosting a series of free informational seminars this summer and fall. Covering topics from empowering women to Social Security and legacy planning, these seminars aim to educate attendees on crucial financial matters. Register for one or all sessions to take charge of your financial future.

Early Retirement Planning

In a bold move, a retired couple has sold their home and business to embark on a 15-year world cruise, embracing life at sea for $3,500 a month. Leaving their life on land behind, they are set to explore the globe aboard an all-inclusive cruise ship, redefining retirement living.

Early Retirement Planning

In recent years, the Financial Independence, Retire Early (FIRE) movement has gained significant attention. Advocates of FIRE aim to achieve financial independence at a young age, allowing them to retire much earlier than the traditional retirement age. But is early retirement through FIRE a realistic goal for most people?

Retirement is often envisioned as a period of leisure, free from the demands of a career. Yet, when the day finally arrives, many retirees find themselves facing unexpected emotional and psychological challenges. The transition from a structured work life to an open-ended retirement can be both liberating and overwhelming. Understanding and addressing the emotional side of retirement is essential for maintaining mental health and enjoying this new phase of life.

Planning for retirement is a journey that requires foresight, discipline, and proactive steps. It’s not just about saving money; it’s about envisioning the future you desire and taking actionable steps to make it a reality. Whether you dream of traveling the world, pursuing hobbies, or spending quality time with family, starting your retirement planning early can make a significant difference.

Retirement marks a significant transition from a life of work to one of leisure. However, many retirees find that they still want to generate income without the demands of a traditional job. Fortunately, there are numerous passive income opportunities that can help retirees maintain financial stability and enjoy their golden years.

Retirement planning is crucial to ensuring financial security in your golden years. One of the key components of retirement income for many Americans is Social Security. In fact, Social Security benefits make up approximately 31% of the income for individuals over 65. Maximizing these benefits can significantly enhance your retirement lifestyle. Here are some strategies to help you get the most out of your Social Security payments.

Retirement planning often feels overwhelming, but understanding how much money you need to retire comfortably is crucial. This guide will walk you through the essential steps to determine your retirement savings goal.

As retirement approaches, many individuals look forward to a life of leisure and relaxation. However, one crucial aspect that often requires careful planning is healthcare. With rising medical costs and the complexities of Medicare, understanding how to manage healthcare expenses is essential for a comfortable retirement.

Retirement marks the beginning of a new chapter—a time to embrace freedom, pursue passions, and enjoy the fruits of decades of hard work. But for many, the looming concerns of fixed incomes and maintaining large homes can dampen the excitement. One solution gaining popularity among retirees is downsizing: reducing living space and possessions to cut costs and simplify life. This transformative process not only offers financial benefits but can also lead to emotional liberation and a more fulfilling lifestyle.

Retirement is a significant milestone that requires careful planning and foresight. Yet, many find themselves unprepared, making common mistakes that can compromise their financial security and overall well-being in their golden years. Understanding these pitfalls and learning how to sidestep them is crucial for a comfortable and fulfilling retirement.

Navigating the world of retirement plans can be overwhelming. With various options available, two of the most popular choices are the 401(k) and the Individual Retirement Account (IRA). Understanding the differences between these two can help you make an informed decision about which plan suits your financial goals.

Retirees aged 73 and older are required to take minimum distributions from their retirement accounts, but with strategic planning, these RMDs can be opportunities rather than obligations. Discover three smart strategies to maximize your savings and minimize taxes by reinvesting, donating, or using RMDs to pay your taxes.

IRAs

As Generation Beta makes its debut, Prudential Financial is offering a $150 “Beta Baby Bonus” to every baby born in the United States on January 1, 2025. This initiative aims to encourage early financial planning for the newest generation amid parental concerns about future retirement and societal shifts.

Early Retirement Planning