Money

A Senate committee in Oklahoma City has passed legislation aiming to reduce property taxes by raising the homestead exemption. Supporters believe this step could provide much-needed relief for homeowners across the state. Local officials see it as a pivotal move to lighten Oklahomans’ tax burden.

Property Tax

Missoula residents can take advantage of free tax preparation at the Missoula Public Library, open to individuals of every age. This service is part of the library’s ongoing weekly engagement with the local community.

Income Tax

As Montana faces confusion over property taxes, a new worry emerges: some politicians could capitalize on taxpayers’ frustration by adding a statewide sales tax. Since Montanans have historically opposed such measures, concern is growing about whether these proposals will gain traction.

Property Tax

Before he ran for office, Sen. Donovan Fenton spent long days in his family’s business. Now, he warns that HB 155 represents a property tax hike in disguise—one that could burden families and small businesses across New Hampshire.

Property Tax

A plan to tax millionaires could dramatically shift the economic landscape in a U.S. state that has stood by a 93-year aversion to any form of income levy. With only limited details available, this potential measure piques nationwide interest, spotlighting the tension between fiscal tradition and changing public priorities.

Income Tax

Calais is on the brink of significant changes as tax sales return and a long-awaited reappraisal of property values concludes. Veteran Town Moderator Gus Seelig is preparing to pass the gavel after one last meeting, symbolizing a changing of the guard in local governance.

Property Tax

A legislative proposal in Illinois seeks to exempt workers’ tip income from state taxes, mirroring a federal “No Tax on Tips” policy. State Rep. Regan Deering is leading the charge, aiming to reduce financial strain on employees whose wages rely heavily on gratuities.

Income Tax

In a display of rare bipartisan agreement, Bend’s Sen. Anthony Broadman is promoting an expanded Earned Income Tax Credit, a policy economists and lawmakers across the spectrum endorse. The proposed increase aims to provide working families with essential financial relief.

Income Tax

When Ohio taxpayers choose the Wildlife Diversity or Nature Preserves and Scenic Rivers funds on their state income tax form, they help protect the state’s endangered plants, animals, and waterways. A simple act at tax time can make a lasting impact on Ohio’s natural heritage.

Income Tax

California Gov. Gavin Newsom continues to oppose a proposed billionaire tax measure, arguing it could push the ultra-wealthy away from the state. Speaking at a Bloomberg forum in San Francisco, he cautioned that this tax might ultimately degrade the state’s financial base.

Income Tax

Gary Griffin and Sandra Brueland will lead a Feb. 9 presentation at Lakes Area Unlimited Learning covering property taxes and fraud protection. Attendees will learn about the potential impact of current tax regulations and practical strategies to avoid scams. This session offers timely insights for residents of the Brainerd Lakes area.

Property Tax

More than six million Americans who typically receive their tax refunds by paper check may be in for an unexpected jolt. Those checks, often used to cover essentials like groceries and utility bills, risk disappearing at a time when many families need them most.

Income Tax

Defiance City Hall reported an 8% rise in income tax receipts for 2025, marking a new milestone in municipal finances. Observers note this growth as a testament to strong public finance under local governance. The increase highlights a significant step forward for the city’s revenue collection.

Income Tax

Loudon is looking to Route 106 to spur new business investment. A proposed tax incentive aims to lighten the property tax load on residents while welcoming fresh commercial opportunities in the area.

Property Tax

A new, wide-scale inspection has been approved for Beatrice, where more than 5,300 residential and 1,300 commercial parcels will undergo thorough reviews. The Gage County Board of Supervisors’ recent decision aims to establish consistent and accurate classifications for properties across the city.

Property Tax

Monzo introduces a free, HMRC-recognized tool designed to assist small businesses in managing their tax obligations. With significant changes on the horizon due to Making Tax Digital, the digital bank’s initiative comes at a crucial moment for UK SMEs.

Tax Filing Software

The Slate Valley Unified Union School Board has given the green light to its fiscal year 2027 budget. This decision could affect property taxes, education spending, and infrastructure plans, reflecting the district’s focus on long-term needs.

Property Tax

Officials in Waseca County are holding firm to their reputation for cautious spending, unanimously approving their 2026 budget along with a property tax levy. The final 2025 meeting of the County Board emphasized continuity, demonstrating a steadfast commitment to fiscal discipline.

Property Tax

In 2025, Island Health secured voter approval for a property tax increase and faced dramatic changes among its leadership. A 28-year commissioner retired, and another longtime board member was replaced by a political newcomer, marking a season of transition.

Property Tax

Starting January 1, property owners can apply for 2026 tax exemptions with the County Assessor’s Office. All applications must be turned in by March 15, ensuring timely processing for those seeking financial relief.

Property Tax

As tax season approaches, Steele County residents will see a 4.6% hike in property taxes for 2026. This modest increase accompanies an $83,559,919 budget approved by the county commissioners on Tuesday evening.

Property Tax

Scotia Global Asset Management recently announced its estimated year-end cash distributions for 2025, detailing projected ETF payout amounts for investors. These estimates may shift slightly before final confirmation on or about December 30, 2025, with distributions set for payment on January 7, 2026.

Income Tax

State lawmakers in New Hampshire are revisiting a bill that would mandate strict caps on school budgets. Critics call this effort a “scheme” that merely pretends to bring relief to property taxpayers, asserting that Granite Staters don’t want such regulations. The letter urges legislators to listen to public sentiment before forging ahead.

Property Tax

A short letter raises concerns about the fairness of certain tax credits, pointing to what the author calls a “Tax credit injustice.” Published on December 12, 2025, by The Spokesman-Review, the piece has sparked attention for its critique of economic policy.

Income Tax

During a recent town hall meeting, Pulaski County officials offered explanations of how property values are assessed, yet many residents left unconvinced. While authorities emphasized transparency, the public raised concerns about possible flaws in the system.

Property Tax

Governor Spencer Cox is proposing a $30.7 billion budget described by his Office of Planning and Budget as a “stay the course” plan. The new fiscal approach includes no income tax cut and is set to take effect when the next fiscal year begins in July.

Income Tax

The Burlington City Council has approved a plan to collect additional revenue through property taxes beginning in 2026. While the exact details remain limited, the council’s decision marks a key step in planning the city’s future budget.

Property Tax

Bethel Park residents will see a minor increase in municipal taxes starting in 2026. According to the original report, this adjustment, described as small, aims to address the community’s future financial needs and maintain services.

Property Tax

A recent editorial questions whether property tax cuts should be at the forefront of the legislative agenda. It advises state leaders to consider the long-term economic outlook before finalizing any reduction in taxation.

Property Tax

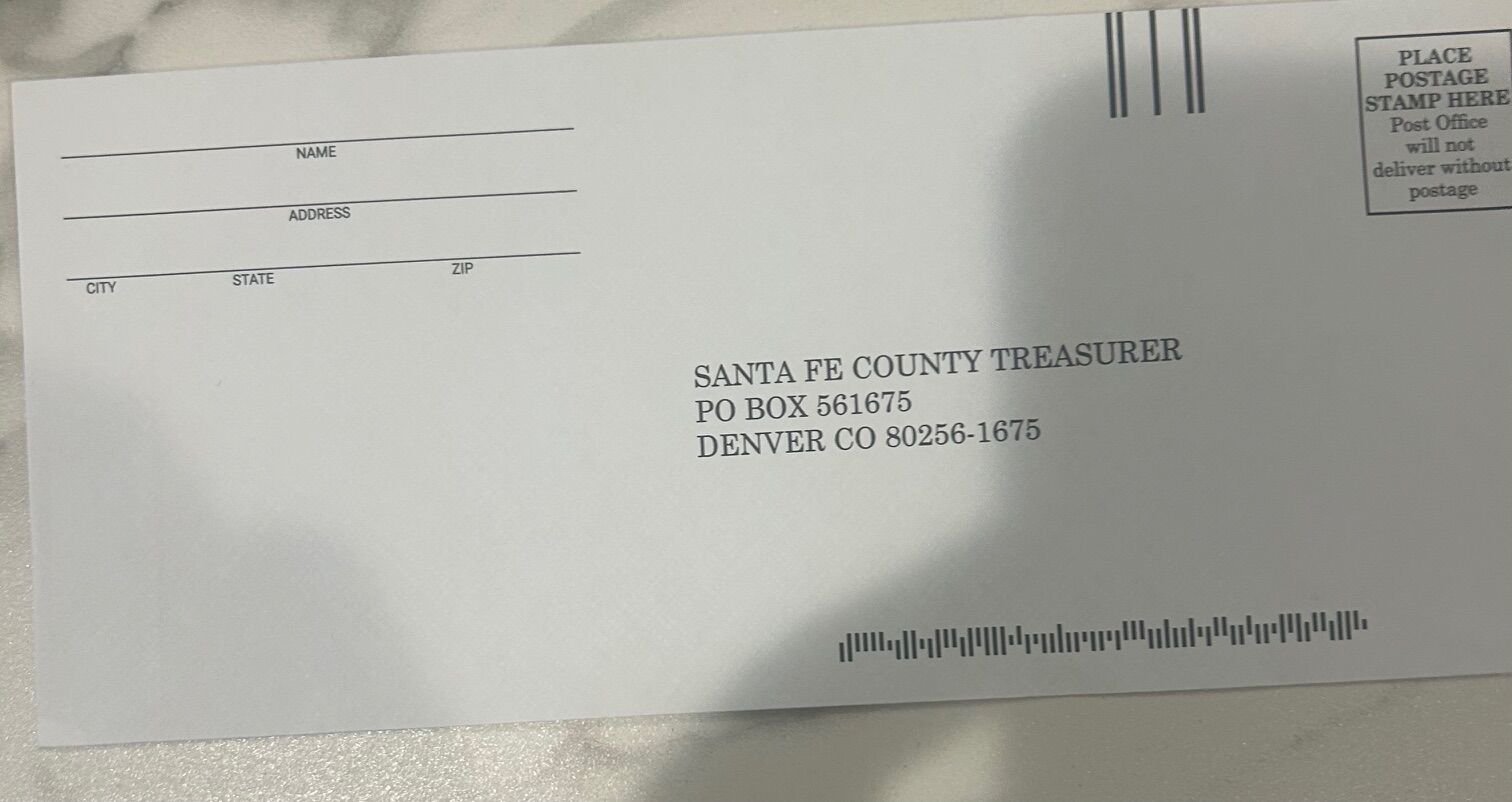

Santa Fe County property tax checks don’t stay in the Land of Enchantment for processing. According to the county treasurer, no local bank is equipped to handle them, leading to a unique solution: sending the payments to Denver.

Property Tax

Birmingham-based SmartWiz is expanding its AI-driven tax software operations and plans to add 66 jobs over the next five years. The company aims to strengthen its presence in the Magic City while enhancing innovative services for tax professionals through advanced artificial intelligence.

Tax Filing Software

Bucks County Opportunity Council has partnered with a local attorney to provide free wills for VITA participants. This timely initiative highlights the importance of both financial and legal security for community members, offering crucial support to those who need it most.

Income Tax

In his candid letter, Marc Bush urges Congress to launch a new era of tariff-based funding for the federal government. Citing America’s early history without income taxes, he argues that returning to tariffs could help avert shutdowns and stabilize the nation’s budget.

Income Tax

Norton’s annual town meeting will feature four critical decisions: how to treat PFAS in local water, whether to upgrade water mains on Elm Street, providing a property tax exemption for disabled veterans and seniors, and lowering the qualifying age from 70 to 65 for that exemption. Attendees will weigh these measures that could significantly affect local infrastructure and tax policies.

Property Tax

Bossier City officials have unveiled an approach they believe will skip a property tax increase while saving local taxpayers nearly $5 million. The plan underscores the city’s broader “fiscal belt-tightening” efforts to manage its next budget without placing further burdens on property owners.

Property Tax

Brazil’s lawmakers have voted to exempt monthly incomes up to 5,000 reais (about US$940) from taxation, aiming to relieve financial pressure on low earners. This shift in fiscal policy could significantly affect the take-home pay of millions of workers across the country.

Income Tax

Schenectady homeowners are facing a $240 annual property tax increase under Mayor Gary McCarthy’s just-released 2026 budget proposal. The plan is set to exceed the state tax cap, sparking questions about its potential impact on residents and city finances.

Property Tax

A once-promising outlook for minimal tax changes has shifted with the Janesville City Council’s approval of a substantial preliminary levy increase. Local residents may now face a steeper property tax burden than initially expected in the coming year.

Property Tax

Virginia taxpayers are set to receive income tax rebates as part of a budget initiative passed by the General Assembly. Governor Glenn Youngkin is using this move to underscore his administration’s commitment to financial relief and bolster his legacy.

Income Tax

Losing an IRS tax exemption leaves nonprofits and their volunteer leaders without critical benefits. Once that status lapses, the organization’s financial advantages—and the income tax perks for volunteers—immediately cease.

Income Tax

Rural leaders in 40 counties are bracing for corrosive budget deficits after the lapse of a federal program designed to compensate for the lack of local taxes on federal land. If no solution is found, these communities fear shortages for essential services ranging from roads to public schools.

Property Tax

The SALT deduction limit is set to rise to $40,000 in 2025. Experts say this could spell significant tax savings for many Americans, particularly those in high-tax states, and even present a rare chance for some to pay 0% capital gains.

Income Tax

Property Tax

A proposal to limit property taxes in Texas cities and counties faces an uphill battle as the special legislative session draws to a close. Lawmakers pushing the plan say it is “on life support,” suggesting that time may be running out for meaningful reform.

Property Tax

Tax season may be months away, but for those who pay quarterly estimated taxes, the September 30 deadline is critical. By acting now and considering deductions, there’s still time to reduce what you owe.

Income Tax

Year-round bookkeeping is the key to stress-free tax filing, explains Sandy Richard of S & A Bookkeeping in Worland, Wyoming. By maintaining steady communication with a bookkeeper and organizing records well in advance, small business owners can avoid unwelcome tax surprises and keep their finances on track.

Income Tax

A longtime West Nashville homeowner worries he may no longer afford the house his father built, as a recent assessment shows the property’s value climbed by $340,000 since 2021. The steep property tax increase now looms as a financial hurdle, potentially forcing him to leave the place he’s always called home.

Property Tax

A recent study indicates that billionaires in the United States may be paying a lower tax rate than most other citizens, pointing to a shift in how top earners contribute. Multiple outlets, including CBS News and The Atlantic, have raised questions about whether recent policy changes favored the ultra-wealthy.

Income Tax

A recent study finds that the wealthiest 400 Americans pay a 24% tax rate—lower than that of the average taxpayer. Economists behind the research say it highlights a growing gap in the country’s tax burdens.

Income Tax

Ten members of the Jacksonville City Council are backing a property tax rate cut, with support from Florida’s GOP Chairman. Mayor Donna Deegan, however, attributes the decision to political pressures from state leaders, highlighting ongoing tensions around local taxation.

Property Tax

David Splinter’s latest commentary reveals that while the U.S. tax system is highly progressive overall, some billionaires may still face lower effective tax rates than previously assumed. His data indicates rates can climb to 45% at the top 0.01% of earners yet could be lower among those with the greatest wealth.

Income Tax

HarperCollins Publishers is looking to build a large-scale logistics facility in Brownsburg, Indiana, backed by a major financial investment. Town officials are discussing a possible tax break to secure the project, which is expected to open in 2028 and generate millions in tax revenue over the coming decade.

Property Tax

For the third year in a row, Missouri City leaders are proposing no changes to the local tax rate. Residents may see this familiar number continue, offering consistency in municipal revenues and civic planning.

Property Tax

Thailand plans to introduce a groundbreaking negative income tax system by 2027, fundamentally reshaping how its citizens and expats navigate financial obligations. A new data lake initiative will also streamline government welfare programs and fiscal management, illustrating the country’s commitment to modernizing its economic infrastructure.

Income Tax

Elon Musk’s SpaceX has paid little to no federal income tax since its 2002 launch, despite securing billions of dollars in U.S. government contracts. A tax maneuver rooted in more than $5 billion in accumulated losses—and made indefinite by a 2017 law—continues to shield the rocket company from the IRS.

Income Tax

Jannik Sinner clinched his first Wimbledon title by defeating rival Carlos Alcaraz, showcasing a strategic mastery that could redefine their storied rivalry. The victory not only marks a milestone in Sinner’s career but also intensifies one of tennis’s most captivating matchups.

Income Tax

Congress has passed President Trump’s nearly 900-page tax and spending bill, enacting $4.5 trillion in tax cuts and significant changes to national defense, immigration, and healthcare programs. The legislation promises wide-reaching impacts on America’s fiscal and social landscape.

Income Tax

As Independence Day approaches, President Trump aims to sign the “Big Beautiful Bill,” a move that Grover Norquist believes will grant Americans the freedom to keep more of what they earn.

Income Tax

Senate Republicans are moving closer to accepting the House’s $40,000 SALT deduction cap, navigating budgetary obstacles to reconcile key legislative differences before the July 4 deadline.

Income Tax

President Donald Trump’s plan to cut taxes by trillions of dollars could lead to billions being trimmed from social safety net programs, including critical food assistance for lower-income Americans.

Income Tax

In a world where splitting a bill is a tap away, Lynn Westmoreland argues that President Trump safeguarded our digital transactions from potential IRS surveillance under Biden’s administration. As cash gives way to apps like Venmo and Cash App, concerns over privacy and government oversight come to the forefront.

Income Tax

US small business sentiment has improved in May for the first time this year, fueled by hopes for President Trump’s spending bill, even as uncertainty and tax concerns loom large.

Income Tax

Discrepancies between your Form 16 and 26AS can lead to missed deductions and potential issues with your tax return. By carefully comparing these forms and alerting your employer to any errors, you can ensure you claim all eligible deductions.

Income Tax

Investor unease gripped the markets Wednesday, highlighted by a bond sell-off and a declining dollar, as lawmakers debated a tax-cut bill that may boost the US deficit. President Trump’s push for the legislation has raised concerns about the nation’s fiscal future.

Income Tax

As Ohio debates eliminating property taxes, leader Russo warns of the absence of alternative funding for schools and essential services.

Property Tax

Berlin’s fiscal year 2026 budget is set for a public hearing on May 28, with recent cuts reducing the tax increase to just 55 cents above the current rate. The city council’s efforts aim to minimize the financial burden on residents while maintaining essential services.

Property Tax

In a decisive move during budget discussions, Kaslo council has approved a nine percent increase in municipal taxes, surpassing staff recommendations. The decision, made on April 15, signals the council’s commitment to addressing the town’s financial needs.

Property Tax

In recognition of the hardships caused by recent disasters, the IRS is granting automatic tax filing extensions to affected individuals. Survivors of wildfires, hurricanes, floods, and tornadoes now have more time to file their taxes without the burden of additional paperwork.

Income Tax

Disabled veterans in Indiana are expressing concern over a proposed bill that could eliminate two property tax deductions they have relied on for 50 years. The House’s version of Senate Bill 1 threatens to remove these longstanding benefits, potentially impacting the financial well-being of veterans across the state.

Property Tax

As tax season approaches, finding the right software to navigate the complexities of tax filing can make all the difference. With numerous options available, selecting a tool that fits your needs can streamline the process and maximize your refund.

Understanding taxes can seem daunting, especially if you’re new to the workforce or navigating self-employment. Taxes play a crucial role in funding public services like education, infrastructure, and healthcare. This guide aims to demystify the basics of taxes, helping you navigate the tax landscape with confidence.

As retirement approaches, one of the foremost concerns is how to preserve your hard-earned savings from excessive taxation. Effective tax planning can significantly enhance your retirement income, ensuring you enjoy the fruits of your labor without unnecessary tax burdens. By understanding various strategies and leveraging tax-efficient accounts, you can minimize taxes on your savings and secure a comfortable retirement.

Tax season often brings with it a whirlwind of stress and confusion. Misconceptions about tax laws can lead to costly mistakes, missed deductions, and even legal troubles. To help you navigate the complex world of taxes, we’ve compiled and debunked some of the most common tax myths.

Understanding the intricate details of the U.S. tax system is crucial for effective financial planning. The United States employs a multi-tiered tax system involving federal, state, and sometimes local taxes. This means that, as a taxpayer, you’re often subject to multiple layers of taxation, each with its own rules and rates.

Navigating the complex world of real estate taxes can be daunting. Whether you’re a homeowner looking to sell, an investor eyeing rental properties, or simply curious about how property taxes work, understanding the nuances can save you money and stress. This comprehensive guide will break down property taxes, capital gains, and other essential tax considerations in real estate.

Navigating a tax audit can be a daunting experience for anyone. However, with proper preparation and understanding of the process, you can approach it with confidence and poise. This article provides comprehensive guidance on how to prepare for a tax audit and what steps to take if you are selected for one.

As tax season approaches, many individuals look for effective ways to minimize their tax liabilities. Understanding and utilizing legitimate strategies can help you keep more of your hard-earned money. Here are some smart, legal methods every taxpayer can employ to reduce their tax bill.

In today’s evolving economy, more people are embracing the flexibility and opportunity that freelancing and side hustles offer. With over 64 million Americans freelancing in 2023, and projections that half of the U.S. workforce will be self-employed by 2027, understanding how to manage taxes has never been more crucial.

Tax season can be a daunting time for many, especially when trying to maximize refunds or minimize tax bills. With ever-changing tax laws and a myriad of potential deductions and credits, it’s easy to overlook opportunities that could save you money. Understanding these often-missed deductions and credits can make a significant difference in your financial outcome.

Retirees aged 73 and older are required to take minimum distributions from their retirement accounts, but with strategic planning, these RMDs can be opportunities rather than obligations. Discover three smart strategies to maximize your savings and minimize taxes by reinvesting, donating, or using RMDs to pay your taxes.

Income Tax

In the wake of Measure R’s narrow defeat, the Red Bluff City Council is weighing new tax proposals to fund urgent road repairs. With worsening road conditions and differing opinions among council members, the decision hinges on public trust and the choice between a general or special tax.

Property Tax

Looking to get your taxes done early and at no cost? The IRS Free File program is now open for the 2025 tax season, offering eligible taxpayers a straightforward way to file federal returns without any fees.

Income Tax

Tax Filing Software

As the Nebraska Legislature convenes for its 90-day session, lawmakers are set to navigate a challenging landscape marked by a significant budget shortfall and pivotal social issues. With one-third of its members new to the unicameral body, the session promises shifts in legislative dynamics and critical decisions that will shape the state’s future.

Property Tax

As housing affordability crises grip cities worldwide, the 19th-century ideas of economist Henry George offer a compelling blueprint for change. Could his single tax theory be the key to addressing modern economic inequality?

Property Tax