Health

Medicare coverage denials can raise many questions for seniors unfamiliar with the appeals process. This article offers a glimpse into a piece that promises guidance on next steps when claims are turned down.

Coverage FAQs

With a contract deadline looming, negotiations between Ascension Texas and Blue Cross and Blue Shield of Texas could leave patients facing higher out-of-network costs. If no agreement is reached by January 1, those insured by Blue Cross and Blue Shield may see their medical bills increase at several Ascension facilities across the region.

Plans and Options

Curative Health has secured $150 million in new funding, solidifying its billion-dollar valuation and transforming the employer health insurance space. Offering a $0-out-of-pocket plan, Curative aims to upend traditional coverage by removing deductibles and copays.

Plans and Options

Ambetter Health, a product of Centene Corporation, will expand its coverage in Pennsylvania’s health insurance marketplace in 2026. This move aims to bring more affordable care options to residents in central Pennsylvania, reflecting a growing commitment to broaden healthcare access in the region.

Plans and Options

Open enrollment season is just around the corner, fueling worries about escalating premiums and growing deductibles. An industry expert urges individuals to make certain moves now to avoid bigger financial hits in the new year.

Coverage FAQs

Plans and Options

In an impactful gesture for Breast Cancer Awareness Month, the manufacturing company Bendix transported around 20 employees via limousine to receive mammograms at the Graves Gilbert Clinic Family Care Center. This initiative aimed to stress early detection while including employees’ spouses and spotlighting critical workplace support for health.

Plans and Options

Spherix Global Insights plans to unveil a Special Topix™ report that dissects how U.S. insurers and pharmacy benefit managers will manage drug access across more than 25 disease areas. The study, due to subscribers by month’s end, promises rare, data-driven insight into formularies, contracting pressures and the post-Inflation Reduction Act landscape.

Plans and Options

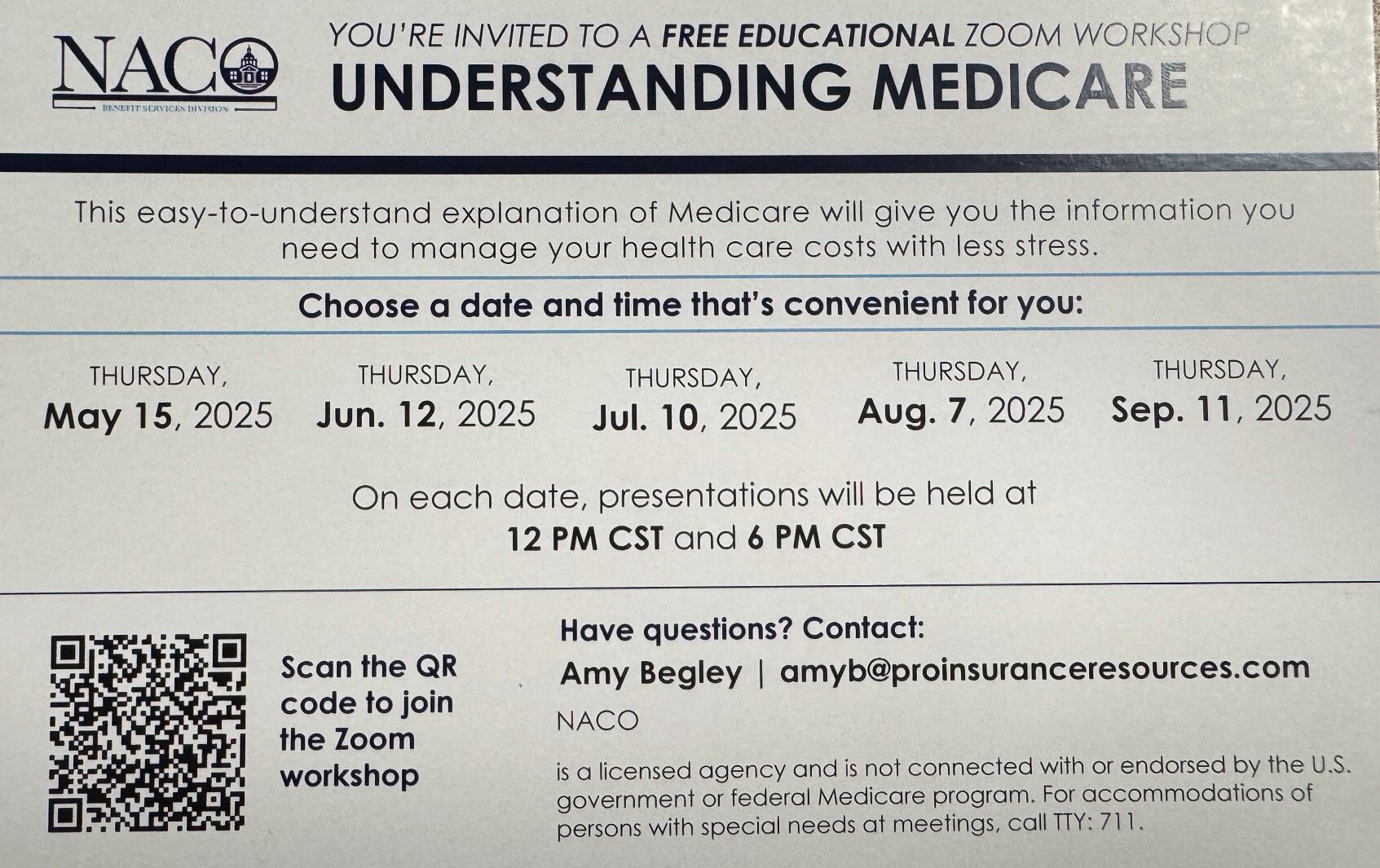

In a bid to educate seniors on their healthcare options, the Nebraska Association of County Officials is offering free online “Understanding Medicare” workshops months before the open enrollment period.

Coverage FAQs

Plans and Options

As the landscape of healthcare evolves, Medicare stands at a pivotal crossroads. With shifts in policy, enrollment trends, and beneficiary needs, understanding the future of Medicare is crucial for millions of Americans. This article explores the potential changes on the horizon and what they mean for beneficiaries.

As you approach the age of 65, understanding your Medicare options becomes crucial for managing your healthcare needs. While Original Medicare (Part A and Part B) provides essential coverage, it doesn’t cover everything. This is where Medicare Supplement Insurance, commonly known as Medigap, comes into play. Medigap is designed to help cover some of the out-of-pocket costs associated with Original Medicare, such as copayments, coinsurance, and deductibles.

Navigating the world of health insurance can be overwhelming, especially when it comes to understanding government-sponsored programs like Medicare and Medicaid. While both programs aim to assist individuals with healthcare costs, they serve different populations and have distinct eligibility criteria. In this article, we’ll explore the key differences between Medicare and Medicaid and help you determine if you or a loved one qualifies for these essential services.

Navigating the complexities of Medicare can be overwhelming. With various enrollment periods, plan options, and coverage details, it’s easy to make mistakes that could cost you time and money. Understanding common pitfalls and how to avoid them is crucial for a smooth transition into Medicare.

Navigating Medicare can be complex, especially when it comes to prescription drug coverage. Medicare Part D is an essential component that helps beneficiaries afford the medications they need. In this article, we’ll explore what Medicare Part D is, how it works, upcoming changes, and how you can make the most of your coverage.

Choosing the right Medicare plan is a crucial decision that can significantly impact your healthcare coverage and out-of-pocket costs. With the options of Original Medicare and Medicare Advantage, understanding the differences is key to making an informed choice.

Navigating the world of health insurance can be daunting, especially as you approach retirement age. Medicare, the federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities, provides essential coverage but comes with a maze of options and details. This guide aims to demystify Medicare, helping you understand your coverage options so you can make informed decisions about your healthcare.

Navigating the complexities of Medicare can be challenging, especially when you’re looking to minimize out-of-pocket expenses. Fortunately, there are several strategies and programs available to help you save money while ensuring you receive the healthcare you need. Here are some practical tips to lower your Medicare costs.

Long-term care costs are rising rapidly, becoming a significant financial challenge for many Americans. As many as 60% of people will require assistance with daily activities like dressing and cooking at some point in their lives. However, there is a common misconception that Medicare covers long-term care expenses.

Medicare fraud has been a significant issue since the program’s inception in 1965, costing the U.S. an estimated $60 billion annually. This staggering loss not only impacts taxpayers but also reduces funds available for essential healthcare services, affecting both beneficiaries and the broader Medicare program. Understanding the common scams and learning how to safeguard your information is crucial in combating this pervasive problem.

Many Medicare beneficiaries plan to switch from Medicare Advantage to traditional Medicare as they age—but they may be in for a costly surprise known as the “Medigap Trap.” Understanding the complexities of Medigap enrollment is crucial to making informed healthcare decisions.

Coverage FAQs

Plans and Options